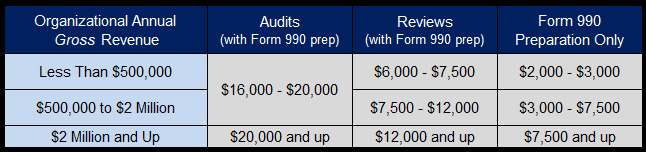

Pricing and fees:

We strive to provide a flat-fee quote prior to each engagement. Even though we mainly perform annual, recurring work for our clients, we treat each year as a new engagement. The annual flat-fee is based on a variety of factors including estimated time needed, scope of engagement, complexities and client's preparation of needed information. We appreciate the need for organizations to budget for the cost of their year-end accounting work. For that reason, we are listing the following guidelines to pricing for services we provide. For situations where the scope of the engagement cannot be estimated, we will accept engagements using our hourly billing rates and strive to perform the services as efficiently as possible.

Initial Year Fee Determination:

To determine the initial year fee, we will need to examine various information from your organization. This would include prior years' filings (Form 990 , Financial Statements etc.), current year financial data and governance documents. Additionally, we may need to speak to a board member, review meeting minutes and communicate with your prior CPA. See below for a list of factors involved in our determination of the scope of the engagement. Please note, our audit and review services normally include the preparation of the IRS Form 990 and state reporting forms. This fee chart is meant as a guide only and is based on our prior client experience. Fees are determined on a case-by-case, year-to-year basis.

Subsequent Years' Fees:

For each subsequent year's engagement, we will re-evaluate the scope using the below factors. We will increase (or decrease) the fee according to changes in the scope of the engagement. If there are no changes in scope from the prior year, there may be small fee increases (typically not more the 5%). Please note each year's fees are quoted before we begin that year's engagement and we encourage our clients to receive other quotes as well.

Non-Attest Services in conjunction with an audit or review:

Some non-attest services can be performed in conjunction with an attest engagement, such as financial statement preparation, accounting adjustments, reconciliations and tax preparation. The organization’s management has to be responsible for the non-attest services by doing the following (1) designating an individual who possesses suitable skill to oversee the service (2) evaluate the adequacy and results of the services performed and (3) accept responsibility for the results of the service. The amount and extent of non-attest services needed can be a large factor in determining the fee.

Non-Attest engagements:

In non-attest engagements, such as Form 990 Preparation only services, there are no independence requirements and, therefore, no limitation on the services we can perform. For these engagements, in addition to the scope factors listed below, fees will be determined based on the extent of services needed. This can range from annual write up services, input from original documentation or preparation from a client's books or schedules. Audit preparation services also need to be priced on a case-by-case basis based on the condition of the organization's books and records.

Additional Fees / Questions or Help Throughout the Year:

Our clients look to us for guidance on nonprofit accounting and other tax exempt (IRS) issues throughout the year. We answer questions and provide information, as needed, for no additional fee. If there is a case where there is a special project or issue that will take significant time, we will discuss a separate fee before beginning service. In no case do our clients get an unexpected bill or invoice. We normally handle topics specific to nonprofit/tax exempt organizations. Typically, areas such as payroll, workers compensation, health insurance, retirement plans, sales tax, bookkeeping, insurance or day-to-day operations are handled internally or by a general accountant.

Factors Involved in Determining Scope of Each Engagement:

** In regards to audits and reviews, a major factor in pricing is the amount and extent of the non-attest services involved in the engagement.

Other factors are:

·

Gross Contributions

(Revenues)

·

Total Expenses

·

Gross Payroll &

Payroll Complexities

·

Number Of Separate

Programs

·

Major New Programs

·

Special Event

Fundraisers

·

Auctions

·

Thrift Stores

·

Gift Shops /

Concession Stands

·

Experience and

capabilities of staff

·

Turnover (Board or

Key Staff)

·

Lawsuits Or Ongoing

Litigation

·

Investigations for fraud

·

Significant

Diversion Of Assets

·

Excess Benefit

Transactions

·

Intended Users Of

Financial Statements

·

Accounting

(Bookkeeping) System

·

Internal Controls

·

Functional Expense

Allocations

·

Material Unusual

Transactions

·

Multiple Locations,

Branches

·

Government Funding

·

Restricted Net

Assets

·

Board Designated

Funds

·

Joint Fundraising/

Program Activities

·

Funding That Has

Restrictions

·

Public Support

Calculations (From 990 Schedule A)

·

Lobbying Activities

(From 990 Schedule C)

·

Investments (From

990 Schedule D)

·

Endowments (From 990

Schedule D)

·

Collections/Works Of

Art (From 990 Schedule D)

·

Foreign Operations (From

990 Schedule F)

·

Grants To Individuals

/ Scholarships (From 990 Schedule I)

·

Fiscal Sponsorship Programs

·

Highly Compensated

Employees (From 990 Schedule J)

·

Related Party

Transactions (From 990 Schedule L)